Cross Border Compliance Solutions

Customs & Taxes Solutions for eCommerce

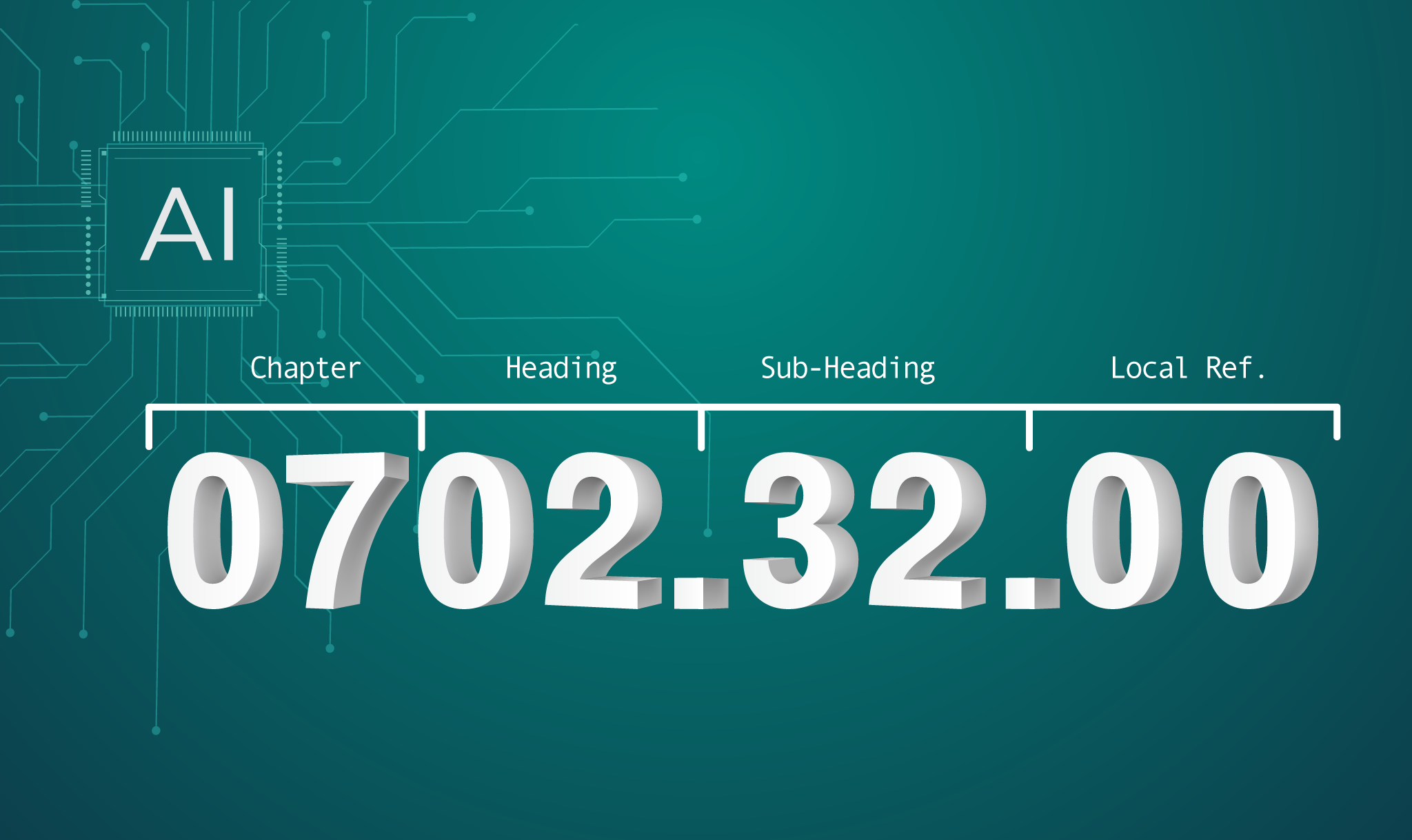

API Modules & Features

End to end eCommerce compliance solutions

The Problem(s)

As the global eCommerce and parcel industry continues to grow exponentially, the volume, complexity & challenges associated with eCommerce, Parcel delivery and cross-border trade are also increasing.

- EU VAT Cross-Border Regulation Changes 01 July 2021

- Brexit

- STOP Act (US)

- ICS2 (2021-2023-2024)

- IOSS (Import-One-Stop-Shop)

Evolving compliance and regulatory burden, financial penalties, delays and associated cost implications for inefficient and non compliant companies are amongst some of the concerns and challenges facing the industry through this period of transformation.

THE SOLUTION

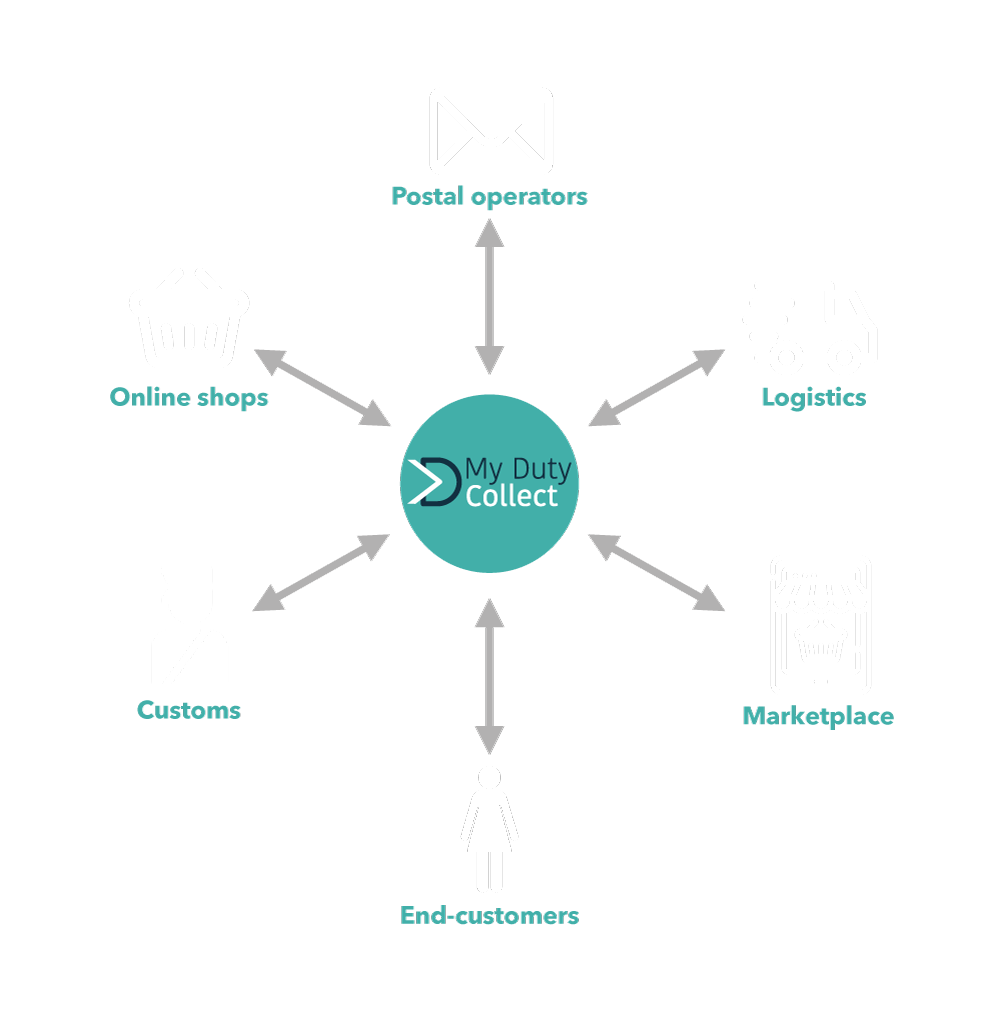

Connecting the whole delivery chain

Our Numbers

My Duty Collect’s versatile and easily integrable solutions are perfect for eCommerce Merchants, Marketplaces, Shipping, Cargo & Supply Chain Companies in DDP and DDU cross-border transactions. Our APIs and Tax advisory services have been designed to improve tax and regulatory compliance for clients across the world. Our mission is to provide comprehensive solutions designed to simplify and transform your cross-border activities.

Get to know our business partners

Learn more about how our combined solutions will enhance your business.

Spectos

By combining our expertise in logistics, supply chain and cross border solutions, we can support our customers in successful enterprise-wide initiatives

Reason Solutions

Our cooperation agreement combines MyDutyCollect cross-border customs, taxes and compliance portfolio & Reason Solutions’ tech platform for postal administrations around the world

WE’D LOVE TO HEAR FROM YOU

Please contact us with any questions and we will be in touch shortly.