FAQ'S

Your Questions Answered

My Duty Collect automates the classification of products based on the World Customs Organisation guidelines, calculates required taxes and customs duties, and automates the collection of Taxes and Duty payments for cross-border e-commerce transactions. MCD is a multi-currency and multi-language system that can be used as a stand-alone service or integrated via API with logistics carriers, marketplaces, and e-commerce stores to deliver greater efficiency on high volumes.

At its core, My Duty Collect is a classification, calculation, and payments automation engine that can be delivered to e-commerce customers, postal & logistics carriers, and other stakeholders who operate on the e-commerce supply chain.

Our ongoing mission is to educate our customers with real-time, usable data and metrics to inform product positioning, pricing and help SMEs to become better at selling online.

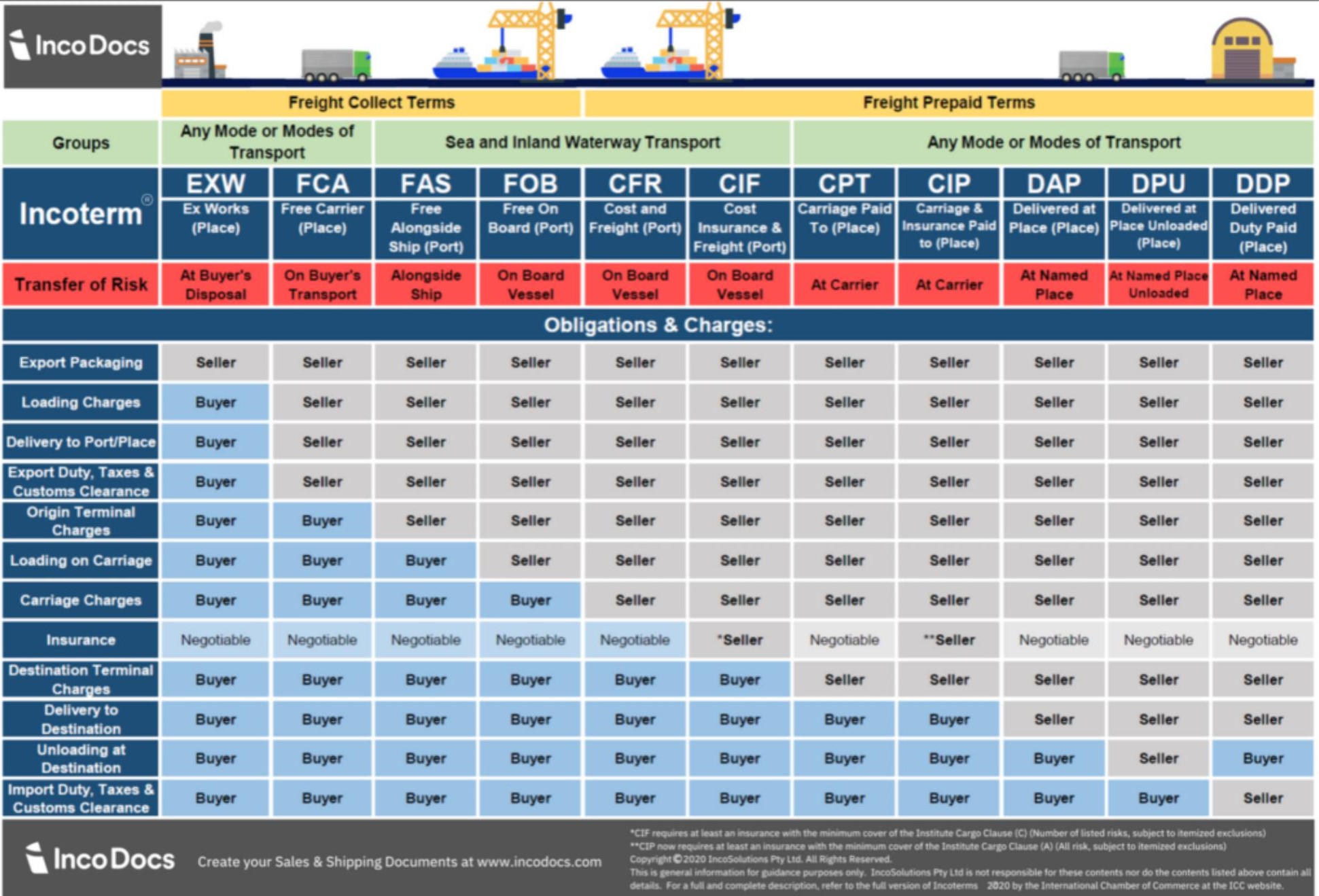

Incoterms is the abbreviation for International Commercial Terms. They summarize the tasks, responsibilities, risks, and shipping costs related to the international shipment standards. These terms define what the sender and the receiver agreed upon before shipping, preventing any misunderstanding regarding shipping costs.

There are 11 Incoterms that are published by the International Chamber of Commerce and relate to international commercial law. They are accepted by governments and legal authorities around the world. The latest version of the Incoterms was released in January 2020. The list is updated yearly.

Retrieved from Incodocs.com

The blue section displays the different types of Incoterms, beginning from left to right. The green section shows the different groups: any mode or modes of transport, sea and inland waterway transport, any mode or modes of transport. The yellow section shows the freight collect terms and freight prepaid terms. Finally, the left blue side of the chart illustrates the different obligations & charges, and displays which are covered by the seller and which are covered by the buyer.

These specific Incoterms are related to getting goods delivered unloaded and customs cleared at the country of destination. Check below the definitions for DAP, DDU & DDP.

DAP (Delivered At Place) – It’s the seller’s responsibility to cover the costs and risks until the cargo is delivered at the designated importing location before being unloaded by the buyer. The latter is responsible for charges such as import customs clearance, duty, and tax.

DDU (Delivered Duty Unpaid) – It’s the buyer’s responsibility to take the costs and risks until the cargo is delivered and unloaded at the importing designated location. The buyer is responsible for import customs.

DDP (Delivered Duty Paid) – The seller is responsible for the costs of import duties, taxes, and customs clearance at the country of destination.

National authorities impose barriers to the entry of certain products through Customs Acts, where a list of goods that are restricted or prohibited from being imported into the country is published. Lists can vary from country to country according to culture, principles, religion, etc.

It’s important to bear in mind the difference between Restricted and Prohibited goods. While the first requires legal approval in the form of a license/permit to enter a country, the second is strictly forbidden from being imported under any circumstances.

From time to time, countries may delete any goods from or add any goods to the Restricted and Prohibited imports list. It’s important to be aware of what those items are so as not to have problems when exporting or importing goods.

Also known as Denied Trade, Denied Party Screening is a general term for when companies/people screen the customers or buyers of their products to make sure they don’t have any sanctions in the US and the UN. The Department of State, the Department of Commerce, and the Department of Treasury of the United States are responsible for issuing lists of individuals, companies, and other organizations who may not be considered safe for trading and doing business with. These lists are used by corporations and business people everywhere else around the world.

Companies do DPS mainly because they seek to comply with international laws and regulations but also to become familiar with whom they are doing business with. Today’s export controls are more targeted at specific entities and individuals who may have somehow violated international regulations than only countries as they used to be before in the 1990s.

DPS simplifies global trade and trade compliance mechanisms by focusing on automating the user experience and business processes to ensure high levels of trade conformance. Our engine will run through lists of customers and screen them searching for information on whether eventual partners are compliant or not.

MCD’s API engine can screen:

● Vendors;

● Suppliers;

● Clients;

● Prospective Hires;

● Research Collaborators.

youreurope/business/taxation/vat/

vat-rules-rates/index_en.htm

The actual cost of a commodity after it has arrived at the buyer’s dooris known as landed costs. The landed cost includes the product’soriginal price, both inland and ocean shipping costs, tariffs, duties,taxation, insurance, currency exchange, and producing, storage, and payment fees.

The total shipping costs, currency exchange, and other fees + the total price of the good(s) = the landed cost formula:

● Ocean Transport;

● Inland Transport;

● Dutyand Tax;

● Currency Conversion;

● Insurance;

● The total price of the product.

CN22 and CN23 are customs declaration forms exclusively used to facilitate the customs clearance processes for both exporter and importer involved parts when goods are shipped outside the EU. Check their difference below:

CN22 FORM – It is required that the exporter fills out this form when the shipped goods weigh up to 2kg and cost up to €425.

CN23 FORM – It is required that the exporter fills out this form when the shipped goods weigh up to 2kg and cost up to €425.

The more details you provide on the CN22/CN23 form, the less are the chances of having problems to get your parcel delivered to your customer.

HS Code is the abbreviation for Harmonized Commodity Description and Coding System. This is a list of multipurpose international product numbers, developed and maintained by the World Customs Organization and accepted worldwide. It’s a sequence of numbers given for every possible product.

An HS code consists of at least six digits and is used by customs to classify the product being shipped. This way it can accurately calculate taxes and duties, apply any necessary restrictions and avoid unwanted delays. You can look up the HS for a product on your country’s government website.

The codes are divided into categories, subcategories, and final specifications. If you want to export a T-shirt, for example, its category (the first two digits) belongs to Textiles and Articles (62), its subcategory (the following two digits) belongs to T-shirts, singlets and other vests (11), and its final specifications (the last two digits) are made of cotton (42).

The final HS Code of the product is 621142.

With this number, customs authorities all over the world can identify the contents of your package. Most countries have a government authority website that can help you with HS codes.

Customs clearance is a mandatory process imposed by Governments when it comes to allowing goods to be transported from a country to another through an authorized customs broker. Such processes can vary according to the sovereign authority of a country in its territory.

Customs authorities can prohibit the entry of products if the customs clearance is not made or is incorrect. Depending on the characteristics of the goods such as value, type, size, the customs officer can check if taxes and duties have been paid.

If all paperwork, duties & levies are ok and taxes are handled properly then the goods should finally be shipped to their destination Therefore, it is of utmost importance for both importers and exporters to have accurate customs cleared documentation when shipping their goods. This may include the need for professional consultancy.

axation_customs/business/vat/

ioss_en

taxation_customs/business

/vat/ioss_en

taxation_customs/business

/customs-procedures/general-overview/single-administrative-document-sad_en

taxation_customs/business/

customs-procedures/general-overview/single-administrative-document-sad_en

The answer is no. Although they are both related to cross-border eCommerce, IOSS (Import One-Stop Shop) and ICS2 (Import Control System 2) are two separate systems with different purposes.

Import One-Stop Shop (IOSS)

IOSS is a simplified VAT payment system that was introduced in the EU in July 2021 that allows businesses to register, collect, and remit VAT on sales of goods valued at up to €150 to customers located in the EU through a single online portal, instead of registering for VAT in each individual Member State where their customers are located. IOSS is designed to make it easier for businesses to comply with VAT obligations and for customs authorities to collect VAT revenue.

Import Control System 2 (ICS2)

ICS2, on the other hand, is a system that was introduced on March 15, 2021, to facilitate the electronic processing and exchange of information on goods entering the EU customs territory. It is used to perform risk analysis and to determine which consignments require further inspection or control measures. ICS2 also facilitates the electronic submission of entry summary declarations for goods brought into the EU.

Main Differences In Summary

● IOSS applies to all distance sales of goods that don’t exceed €150, while ICS2 applies to all goods entering the EU.

● IOSS is mainly used by eCommerce traders selling goods to EU-based customers from third countries, while ICS2 requires Economic Operators to submit an Entry Summary Declaration (ENS) to the customs authorities electronically before the goods arrive at the EU borders.

● IOSS provides information on the value of goods, the VAT rate applied, and the amount of VAT collected, while ICS2 requires information on the goods, their transport, and the parties involved in the shipment.

● IOSS requires sellers to register and pay VAT on a monthly basis, while ICS2 requires Economic Operators to submit an ENS at least 24 hours before goods are loaded onto the transport vehicle.

Failure to comply with IOSS may result in penalties and fines, while failure to comply with ICS2 may result in delays and additional costs associated with physical or documentary checks.

So while IOSS and ICS2 are both related to cross-border eCommerce sales within the EU, they serve different purposes. IOSS is focused on simplifying the VAT payment process for businesses, while ICS2 is focused on enhancing the security of the EU’s external borders by enabling customs authorities to monitor goods entering and exiting the EU.